Thanks Putin! German stocks pummeled普京感謝!德國股市重挫

August 8, 2014: 9:42 AM ET

German investors are feeling the pain of escalating tensions with Russia that may have already pushed Europe's largest economy into reverse.

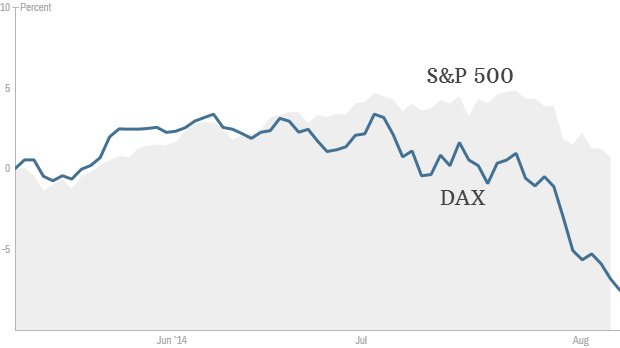

The country's main stock index has fallen by 11% from its peak in late June on fears of a trade war. That means the market is now technically in a "correction."

The DAX index is comprised of 30 major companies such as Adidas (ADDYY), Volkswagen (VLKAY),Siemens (SIEGY) and Deutsche Bank (DB). It was down by more than 1% Friday before trimming its losses. It has fallen by about 6% so far this year.

Europe, the U.S. and other Western nations have issued increasingly tough sanctionsagainst Russia over its role in destabilizing parts of Ukraine.

Russian President Vladimir Putin responded this week by banning various food importsfrom the U.S., Europe, Australia, Canada and Norway.

Several companies have already warned of damage to come, and economic data have soured as businesses postpone big spending decisions. Germany is Russia's biggest trading partner in Europe and thus has most to lose.

Now Russian leaders are considering further retaliatory measures, including closing off the country's airspace to European and U.S. airlines. That could cost European airlines $30,000 each flight if they're forced to fly longer routes to Asia, Russian media have reported.

Shares in Germany's Lufthansa (DLAKF) fell nearly 3% Friday.

"We are potentially ready to introduce protective measures in aircraft building, shipbuilding, automobile manufacturing industries and in other sectors," said Russian Prime Minister Dmitry Medvedev.

Related: How much will Russia's food ban cost Europe?

Adidas slashed its earnings forecast last week, blaming weak Russian business as a key factor. Its shares have fallen by nearly 40% since the start of the year.

Shares in German defense contractor Rheinmetall have fallen about 5% since it warned that sanctions against Russia would hit 2014 earnings. Germany has canceled an export license for a big Rheinmetall contract with Russia.

European GDP data next week will give investors a sense of how bad the fallout from the Ukraine crisis has been. Some economists say Germany's economy may have shrunk in the three months to the end of June.

And growth in the eurozone as a whole may have all but evaporated after a measly 0.2% quarter-on-quarter gain in the first three months of the year.

普京感謝!德國股市重挫

由Alanna佩特羅夫 @AlannaPetroff 2014年8月8日:上午09時42 ET

投資令人不安次

368

股份總數

194

161

13

倫敦(CNNMoney)

德國投資者都感覺緊張局勢升級與俄羅斯的可能已經推動歐洲最大的經濟逆轉的痛苦。

該國的主要股指已經從高峰上貿易戰的擔憂下降了11%,6月下旬。這意味著市場目前在技術上處於“修正”。

該DAX指數是由30個主要公司如阿迪達斯 (ADDYY),大眾汽車 (VLKAY),西門子 (SIEGY)和德意志銀行 (DB)。則下跌超過1%,週五微調其損失之前。它約6%降至今年迄今。

歐洲,美國和其他西方國家已經發出越來越強硬的制裁對其的破壞穩定的作用部位對俄羅斯烏克蘭。

俄羅斯總統普京本週回應禁止各種食品的進口來自美國,歐洲,澳大利亞,加拿大和挪威。

有幾家公司已經警告說,損壞的來,經濟數據惡化,因為企業推遲大消費決策。德國是歐洲俄羅斯最大的貿易夥伴,因此具有最慘重損失。

DAX指數與標準普爾

現在,俄羅斯領導人正在考慮進一步的報復措施,包括關閉了該國領空的歐洲和美國的航空公司。這可能會花費歐洲航空公司30000美元每次飛行,如果他們被迫長航線飛往亞洲,俄羅斯媒體紛紛報導。

在德國的股價漢莎航空公司 (DLAKF)跌近3%,週五。

“我們可能準備介紹在飛機製造,造船,汽車製造等行業和其他行業的保護措施,”俄羅斯總理德米特里·梅德韋傑夫說。

相關閱讀:如何很大程度上將俄羅斯禁止糧食成本歐洲?

阿迪達斯預測下調了盈利,上週疲軟歸咎於俄羅斯商業的一個關鍵因素。自今年年初其股價已經下跌了近40%的下降。

在德國的國防承包商萊茵金屬公司的股價已下跌了約5%,因為它警告說,反對制裁俄羅斯將達到2014年的盈利。德國已經取消了與俄羅斯大萊茵金屬公司的合同出口許可證。

下週歐洲GDP數據將給予投資者多麼糟糕的烏克蘭危機的影響一直的感覺。一些經濟學家說,德國經濟可能萎縮在三個月至6月底。

和成長在歐元區作為一個整體可能會所有,但之後只有區區0.2%,較上一季度的收益在今年前三個月蒸發。

留言列表

留言列表

{{ article.title }}

{{ article.title }}