Opinion: Brace yourselves for another financial crash觀點:振作自己的另一場金融崩潰

Dow suffers biggest point drop of 2014

- Steve Keen says we haven't yet left the last financial crisis

- Financial crises end when their causes are unwound, which has not happened, he says

- The markets are suffering the worst slide since 2011

- Keen says that debt data suggest the stock market was due for a fall since mid-2013

Editor's note: Professor Steve Keen is the head of Economics, History & Politics at Kingston University London, the author ofDebunking Economics, and the publisher of a Debtwatch blog. The opinions expressed in this commentary are solely those of the author.

(CNN) -- The stock market's recent jitters have made many investors wonder whether there's a new financial crisis just around the corner. Well, of course there isn't -- because we've never really left the last one.

Financial crises of the scale of the 2007 crash only really end when their causes are unwound by debt repayment, bankruptcies, debt write-offs, and inflation.

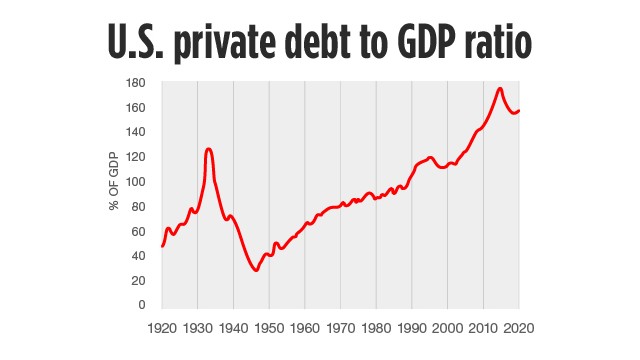

In the 1930s, there was plenty of all four. The end result was that US private debt fell by almost 100% of GDP from its deflation-spiked peak of 130% in 1933, to a low of 35% at the end of WWII.

By comparison, the debt cutting we've been through so far in this crisis is trivial -- a fall of under 20% from a far higher peak of 175% in 2010.

We're attempting an economic revival from a debt level that exceeds the worst level reached during the 1930s.

And we thought this was going to work?

It has and will, of course, for a while. So long as we're willing to borrow more than we repay, there will be growth. Rising debt means there is more money in the system, driving up the economy.

That has been happening since early 2010, when the deleveraging that caused the 2007 crisis stopped, and Americans began to borrow again.

But with private debt still at levels that make the late 1920s seem like a period of sobriety rather than Great Gatsby excess, the headroom to keep on borrowing simply isn't there. So the economic revivals are likely to peter out much more rapidly than they did back in 1990, when debt peaked at "only" 120% of GDP.

Nowhere is this more evident than in that ultimate casino, Wall Street. There, margin debt has already returned to the peak it reached back in the biggest stock market bubble of all time, the DotCom bubble.

The increase then was stunning: having hardly ever exceeded half a percent of GDP before 1990, it rose fivefold to 2.75% of GDP in just 8 years. We hit that peak again in March 2014 -- and we thought it could keep on rising?

Of course, we thought no such thing because, with the earnest assistance of conventional economic thinking, we convinced ourselves that leverage didn't affect stock market prices and that instead prices reflect this ethereal thing called "fundamental value."

To my eye, the real "fundamental value" is our willingness to go into debt to buy an asset.

That willingness rises as rising debt drives asset prices higher. But it also ultimately peters out, since the debt rises much more rapidly than the incomes that pay these debts off.

Then the Catch-22 of financial markets takes over: It takes not merely rising but accelerating debt to keep stock prices rising. Even a slowdown in the rate of acceleration of debt is enough to send the stock market south.

My acceleration indicator has been flagging that the stock market was due for a fall since mid-2013.

It's a tribute to the power of the Fed's Quantitative Easing that the market continued to defy the gravity of decelerating debt for so long. QE was really a program to inflate asset prices since, as my colleague Michael Hudson puts it, "the Fed's helicopter money fell on Wall Street, not Main Street".

But with QE being unwound, the stock market is now back under the control of the not so tender mercies of excessive private debt.

So welcome to the New Crisis -- same as the Old Crisis. The roller coaster ride is likely to continue.

觀點:振作自己的另一場金融崩潰

由史蒂夫敏銳,特向美國有線新聞網

2014年10月15日 - 更新1606 GMT(0006 HKT)

觀看此視頻

道指蒙受了2014年的最大點數跌幅

新聞提要

史蒂夫敏銳的說,我們還沒有離開的一次金融危機

金融危機結束時,他們的原因是開卷,這還沒有發生,他說:

市場正在遭受最嚴重的滑自2011年以來

基恩說,債務數據表明,股市是由於對自2013年年中下降

編者按:史蒂夫敏銳的教授是經濟學,歷史和政治的負責人金斯頓大學倫敦的作家揭穿經濟學,和一個出版商Debtwatch博客。發表本評論中的觀點僅為作者。

(CNN) -在現貨市場近期的恐慌已經使許多投資者不知道是否有一個新的金融危機指日可待。嗯,當然沒有-因為我們從來沒有真正離開最後一個。

金融危機2007年的崩潰才真正結束時,其原因是由償還債務,破產,註銷債務,通貨膨脹解開的規模。

在20世紀30年代,出現了大量的所有四個。最終的結果是,美國的私人債務,在二戰結束時下跌了從通縮,加標了130%的峰值幾乎占到GDP的100%,1933年為35%的低點。

相比之下,債務切割,我們已經通過迄今在這場危機中是微不足道的 - 從175%,2010年遠高於峰值下降了20%以下。

我們嘗試從超過20世紀30年代達到了最嚴重的級別債務水平的經濟復甦。

我們認為這是去上班?

它當然會,一會。只要我們願意借更多的比我們還的,會有增長。不斷增加的債務意味著有更多的錢在系統中,抬高了經濟。

美國的私人債務美國的私人債務

道指蒙受了2014年的最大點數跌幅 噓!十月往往是可怕的個股

已經發生自2010年年初的時候,導致2007年危機的去槓桿化停止,美國人又開始借錢。

但隨著私人債務仍然在一定水平,使20世紀20年代末似乎是一段清醒,而不是了不起的蓋茨比超過,淨空,以保持借貸根本是不存在的。因此,經濟的復興很可能逐漸消失速度遠遠超過他們在1990年,當債務達到高峰,“只有”120佔GDP的百分比沒有回來。

無處這是更加明顯比在最終的賭場,華爾街。在那裡,保證金債務已經回到了它最大的股市泡沫的所有時間,在網絡泡沫達到回高峰。

那麼增加是驚人的:1990年以前有很少超過了GDP的半個百分點,這五倍上升到國內生產總值的2.75%,在短短的8年。我們再次創下峰值2014年3月 - 我們認為它可能繼續上漲?

當然,我們認為沒有這樣的事情,因為,與傳統經濟思想的認真協助下,我們相信自己,槓桿率並沒有影響股市上漲,而不是價格反映了這種空靈的東西叫做“基本價值”。

在我的眼裡,真正的“基本價值”是我們願意去舉債購買資產。

這種意願上升為債務驅動的資產價格上漲較高。但是,這也最終消散,由於債務更加迅速上升比支付這些債務了收入。

然後抓住-22金融市場的接管:這需要不僅上漲,但加速的債務,以保持股票價格的上漲。即使是在經濟放緩的債務加速的速率足夠高南派股市。

我的加速度指標已經萎靡不振的股市是由於對自2013年年中下降。

這是一個讚揚美聯儲的量化寬鬆的力量,市場繼續無視減速債務如此之久的嚴重性。量化寬鬆政策是一個真正的計劃,以抬高資產價格,因為,正如我的同事邁克爾·赫德森所說,“美聯儲的直升機撒錢落在了華爾街,而不是主街”。

但隨著量化寬鬆政策退繞,股市現在已經回到了過多的私人債務不那麼慈悲的控制之下。

因此,歡迎廣大新危機 - 與舊的危機。過山車很可能會繼續下去。

留言列表

留言列表

{{ article.title }}

{{ article.title }}